Help to Buy in The Scottish Borders

Help to Buy in the Scottish Borders: M&J Ballantyne are help to buy builders.

What is the Help to Buy Scotland Affordable New Build Scheme?

The Help to Buy (Scotland) Affordable New Build Schemes comprise two schemes which help buyers who would not otherwise be able to do so to buy an affordable new build home from a participating home builder.

The main Affordable New Build Scheme is available to larger homebuilders while the Help to Buy (Scotland) Smaller Developers New Build Scheme is available to smaller home builders.

The rules to both schemes are identical and the agents administering the schemes will identify which scheme your application is to be processed under. Here's a short summary of how the Help to Buy Scotland Affordable New Build schemes work:

- the schemes are only available on new build homes from participating help to buy builders and on homes up to a maximum value of £200,000 for purchases on or before 31 March 2019.

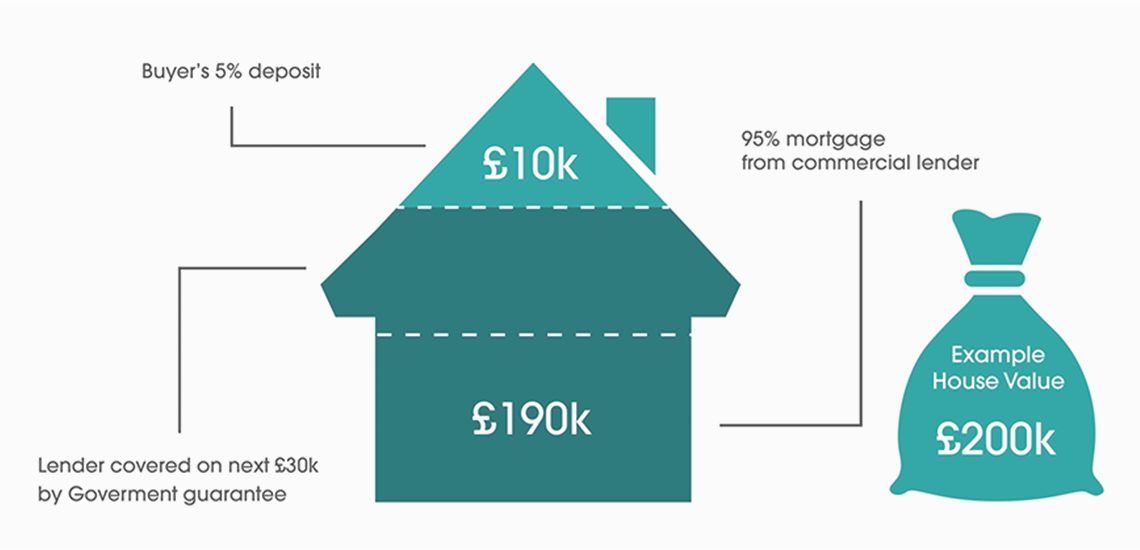

- your mortgage lender is likely to require you to contribute a deposit of around 5%, your mortgage and deposit must cover a combined minimum 85% of the total purchase price.

- your mortgage from one of the participating lenders must be a repayment mortgage, of at least 25%, and cannot be an interest-only first mortgage;

- the Scottish Government will help buyers to purchase the property by taking an equity stake of up to a maximum 15% of the value of the property;

- no annual interest is charge on your equity stake;

- the Scottish Government’s equity stake can be repaid at any time and is based on the value of the property at the time of the repayment;

- the scheme is only available to those who are unable to afford to purchase the property without the Government purchasing an equity share in the property, i.e. if you are able to afford over 100% of the purchase price through a combination of available mortgage and deposit your application will not be eligible;

- the scheme is not available to a single person who requires a mortgage of more than 4.5 times their income or couples that require a mortgage of more than 3.5 times their joint income; and

- there are currently eight participating lenders offering mortgages for the Help to Buy (Scotland) Affordable New Build schemes, please contact them to check what their lending criteria is.

If you are interested in the scheme, what should you do?

-

Firstly, you should read the information leaflet for buyers which will provide you with important information on how the scheme operates.

- Once you have read the information leaflet, you will need to search for Help to Buy Affordable New build homes that are for sale by a participating home builder. The properties may be marketed for sale on estate agents’ websites, home builder’s websites, in local newspapers, or on the radio;

- contact the home builder for further details and to arrange viewings;

- speak to an Independent Financial Advisor or a participating lender before you submit an application form to one of the agents administering the scheme on behalf of the Scottish Government;

- You cannot submit an application form more than 9 months before the anticipated completion date;

- you should not submit a full mortgage application until you have received an 'Authority to Proceed’ from one of the administering agents informing you that your application is eligible to participate in the scheme;

- the scheme is a demand-led scheme and once its budget is fully allocated no further applications can be considered;

- please apply at least three months in advance of the completion date to allow the necessary legal paperwork to be completed.

M & J Ballantyne participate in this scheme as help to buy builders in the Scottish Borders and has made it available on all of our current properties.

*YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE OR ANY OTHER DEBT SECURED ON IT. With Help to Buy (Scotland) Affordable New Build scheme, homebuyers with a minimum of 5% deposit can receive an interest free equity stake of up to 15% of the value of their new home from the Scottish Government, which can be repaid at any time, leaving only a 80% mortgage to secure with a lender. The scheme is available on new-build properties across Scotland. The prices of homes supported by the scheme is up to a maximum value of £200,000 for purchases on or before 31 March 2019. Terms and conditions apply.

M & J Ballantyne

24 Shedden Park

Kelso

Roxburghshire

TD5 7AL